By paying into the Scheme now, you are taking important steps towards preparing for retirement.

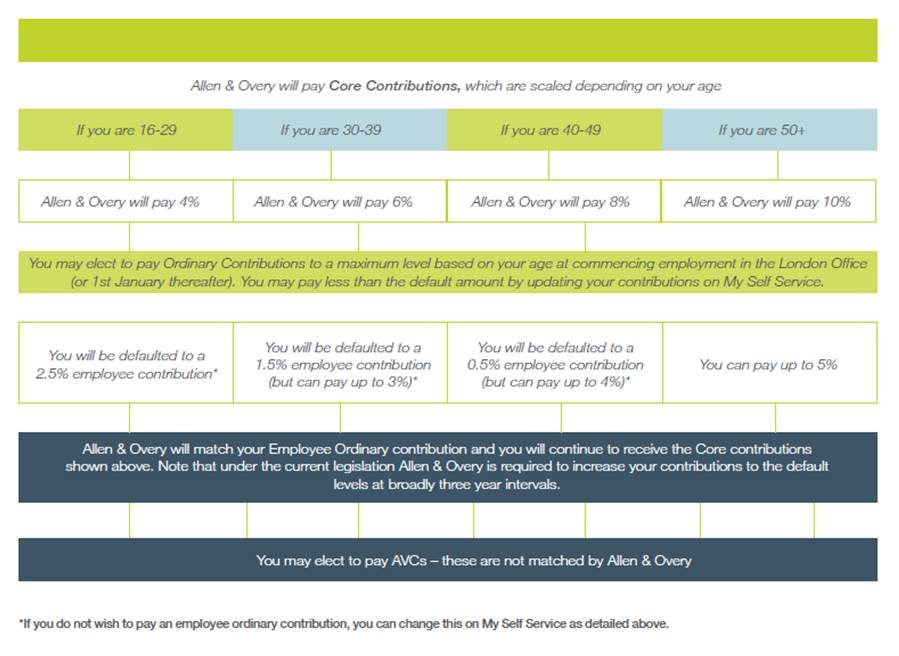

Contribution levels are set on an age-related scale (see the flow chart below for details).

All the contribution types detailed above are based on your capped Pensionable Salary, and are deducted automatically via payroll from your pay in order to ensure the correct tax relief is granted at source.

Both categories of members can pay Additional Voluntary Contributions (AVCs) but they will not attract any further contributions from Allen & Overy. AVCs plus any Ordinary Contributions can be made up to a maximum of 80% of gross monthly earnings from Allen & Overy. AVCs are processed through the payroll in order for you to receive your full tax relief at your highest marginal rate. Restrictions apply to ensure you leave enough pay to cover your other statutory deductions such as National Insurance.

If your pension savings exceed the £60,000 Annual Allowance in any Pension Input Period (PIP), a special tax charge is payable on the surplus savings above this amount. The PIP for the Scheme aligns with the tax. Thus, your Pension Input Period for the 2023/24 tax year will be the year 6 April 2023 to 5 April 2024. Due to payroll processing, the last contribution that will be included in the current PIP year will be your February contribution, which is invested in March. Your March contribution will be received after 5 April and will therefore be recorded in the following PIP year. We recommend that you seek financial/tax advice if you think you will be likely to exceed this allowance.

The Annual Allowance (AA) is the amount of pension savings that can be made in a single tax year before extra tax is payable. The AA for the 2023/24 tax year is £60,000 for most people, but it will be less for those whom the pensions tax regime deems to be on "high income". Broadly speaking, if your total taxable income is above £200,000 (which includes any taxable income from outside of your Allen & Overy employment) in a tax year, then you could have a personal AA which is below £60,000. The Firm as your employer does not have visibility of all your income so you will need to calculate what your personal AA limit is.

Please refer to the Annual Allowance, Lifetime Allowance and Pension Input Period notes in the Glossary of terms section for information on the maximum tax free payments you may make to your pension arrangements.

| Category A | Category B |

| How it works in practice | How it works in practice |

| A member aged 25 has a Pensionable Salary of £20,000 pa. The member decides to pay Ordinary Contributions of 2% to the Scheme which amount to £33.33 a month (£400 a year). With tax relief (assuming a basic rate of 20p in the £) it only costs £26.66 a month (£319.92 per annum). However, because of Allen & Overy's contributions, the member will have the benefit of contributions far greater than this amount. | A member has a Pensionable Salary of £20,000 pa. The member decides to pay Ordinary Contributions of 3% to the Scheme which amount to £50.00 a month (£600 a year). With tax relief (assuming a basic rate of 20p in the £) it only costs £40 a month (£480 per annum). However, because of Allen & Overy's contributions, she will have the benefit of contributions far greater than this amount. |

| Member's Ordinary Contributions: £20,000 x 2% = £400 | Member's Ordinary Contributions: £20,000 x 3% = £600 |

| Employer's Core Contributions: £20,000 x 4% = £800 | Employer's Contributions (double the Memberís Ordinary Contributions): £20,000 x 6% = £1,200 |

| Employer's Matching Contributions: £20,000 x 2% = £400 | |

| Total contributions for year = £1,600 at a personal cost of £319.92 | Total contributions for year = £1,800 at a personal cost of £480.00 |

For Category A members, Allen & Overy's Core Contributions automatically increase with effect from the 1st January following any change to your age band.