|

The Scheme has two categories of DC membership |

|||||||||||

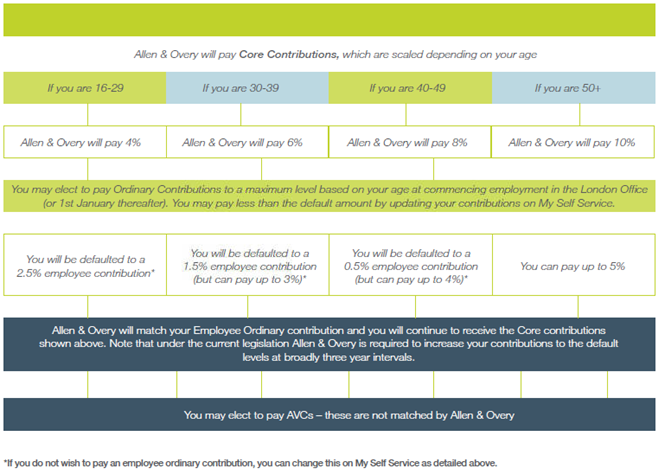

Category A - this membership category applies to members whose employment with the Firm began before 1 April 2021. Pension contributions are based on salaries on 1 January each year (subject to a cap which applies for higher earners). The contributions payable into the DC Section for Category A members are currently age-related. |

|||||||||||

|

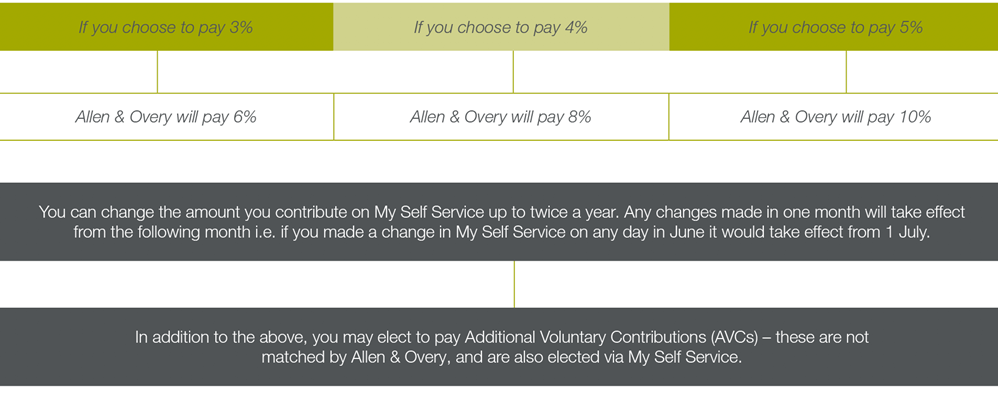

Category B - this membership category applies to members whose employment with the Firm begins on or after 1 April 2021. Rather than being based on fixed 1 January salaries, pension contributions in this category will be based on actual salaries each month (subject to a cap applying for higher earners). The contributions payable into the DC Section for Category B members will not be age-related. Instead, members can select a contribution rate of 3%, 4% or 5% of pensionable salary, and the Firm will then contribute twice this amount. |

|||||||||||

All Category A members can choose to move into Category B. This can be done via My Self Service. If you opt to move into Category B, the decision is irreversible and it will not be possible to subsequently move back to Category A. All new employees hired or rehired by the Firm from 1 April 2021 will be automatically enrolled into Category B. Category A will not be available for new hires. |

|||||||||||

| until | |||||||||||

You leave |

You die in service |

You retire |

|||||||||

You can leave your

Retirement Account

invested in the Scheme until you claim your retirement benefit.

|

A lump sum related to your

Salary

will be payable.*

|

The cash value of your

Retirement Account

will be used to provide you with benefits that are based on the options you have selected.

|

|||||||||

| If you leave the Scheme with less than 30 days' Pensionable Service, any contributions you have made will be returned via payroll and you will have no holding in the Scheme. | |||||||||||

What is the Category A contribution structure?

What is the Category B contribution structure?